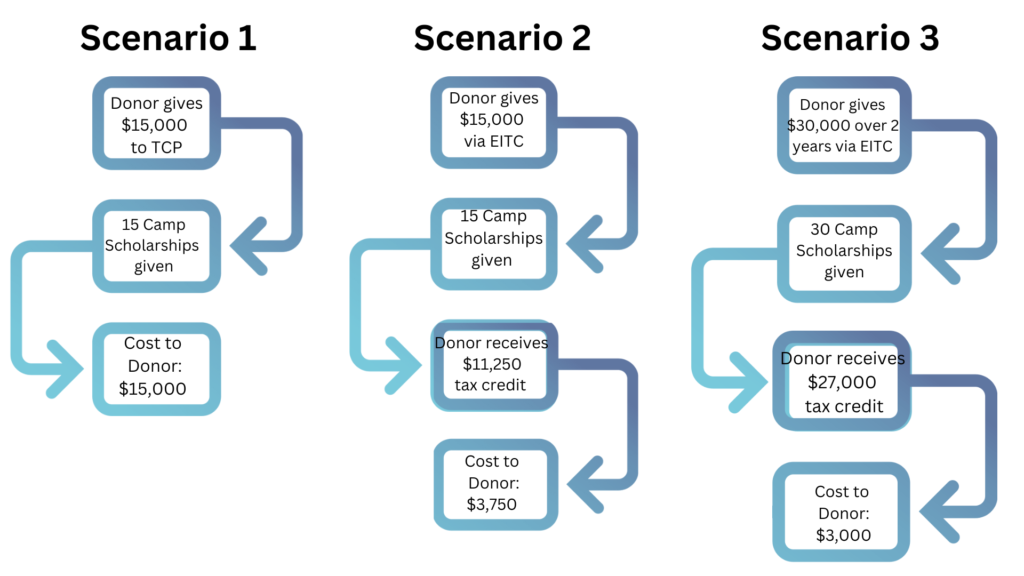

Friends of TCP, we are always looking for new ways to resource our operations here at 58th and Chester. One of the most beneficial revenue streams for us comes through Pennsylvania’s EITC (Educational Improvement Tax Credit) program. This program has amazing benefits for both our Scholars and our generous donors. For instance, imagine a cash gift where a donor gives $15,000 toward our summer camp. In this case (Scenario 1), 15 camp scholarships are given, and the cost to the donor is $15,000.

But what if our donor decides to give the same amount through the EITC program? In this case (Scenario 2), TCP still gives out 15 camp scholarships, and the donor receives a tax credit for 75% of their donation. The total cost to the donor is only $3,750. To save even more, a donor could commit $15,000 a year for two years in a row, increasing their tax credit to 90% (Scenario 3.) The Common Place gives out 30 camp scholarships, costing the donor $3,000.

As you can see, this program has wonderful possibilities. If you are authorized to do business in Pennsylvania and pay any of the following taxes, you can apply to be part of this program:

- Personal Income Tax

- Capital Stock/Foreign Franchise Tax

- Corporate Net Income Tax

- Bank Shares Tax

- Title Insurance & Trust Company Shares Tax

- Insurance Premium Tax (excluding unauthorized, domestic/foreign marine)

- Mutual Thrift Tax

- Malt Beverage Tax

- Surplus Lines Tax

The business application guide can be found here.

We at TCP appreciate your ongoing support. If you have questions about getting involved in the EITC program, please contact our Development Office for assistance.